Examine This Report on Hsmb Advisory Llc

Wiki Article

The Main Principles Of Hsmb Advisory Llc

Table of ContentsThe 5-Minute Rule for Hsmb Advisory LlcThe Best Strategy To Use For Hsmb Advisory LlcSome Known Details About Hsmb Advisory Llc Unknown Facts About Hsmb Advisory LlcThe Best Guide To Hsmb Advisory Llc4 Simple Techniques For Hsmb Advisory Llc

Ford states to avoid "cash worth or long-term" life insurance policy, which is even more of an investment than an insurance. "Those are very made complex, featured high commissions, and 9 out of 10 individuals do not need them. They're oversold because insurance agents make the largest compensations on these," he states.

Handicap insurance can be pricey. And for those that opt for long-term care insurance coverage, this plan might make disability insurance unneeded.

Everything about Hsmb Advisory Llc

If you have a persistent health and wellness issue, this kind of insurance coverage can finish up being important (Life Insurance). Don't allow it worry you or your financial institution account early in lifeit's generally best to take out a plan in your 50s or 60s with the expectancy that you will not be utilizing it till your 70s or later.If you're a small-business proprietor, take into consideration safeguarding your livelihood by acquiring company insurance coverage. In the event of a disaster-related closure or period of restoring, organization insurance can cover your income loss. Think about if a substantial weather occasion influenced your store or manufacturing facilityhow would certainly that impact your income? And for for how long? According to a record by FEMA, between 4060% of tiny organizations never ever resume their doors following a catastrophe.

And also, utilizing insurance coverage could sometimes cost more than it saves over time. If you get a chip in your windscreen, you may take into consideration covering the fixing expense with your emergency situation savings instead of your automobile insurance coverage. Why? Since using your auto insurance coverage can create your regular monthly premium to rise.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Share these suggestions to safeguard loved ones from being both underinsured and overinsuredand talk to a relied on specialist when required. (http://tupalo.com/en/users/6280892)Insurance that is bought by a here private for single-person protection or insurance coverage of a family. The specific pays the premium, rather than employer-based health insurance where the employer usually pays a share of the premium. Individuals may purchase and purchase insurance coverage from any kind of strategies readily available in the individual's geographical area.

Individuals and families may qualify for financial aid to lower the cost of insurance coverage costs and out-of-pocket costs, but only when enlisting through Link for Health Colorado. If you experience specific modifications in your life,, you are eligible for a 60-day time period where you can sign up in a private plan, even if it is beyond the annual open enrollment duration of Nov.

The Ultimate Guide To Hsmb Advisory Llc

- Attach for Health Colorado has a full listing of these Qualifying Life Events. Reliant children that are under age 26 are qualified to be included as member of the family under a parent's protection.

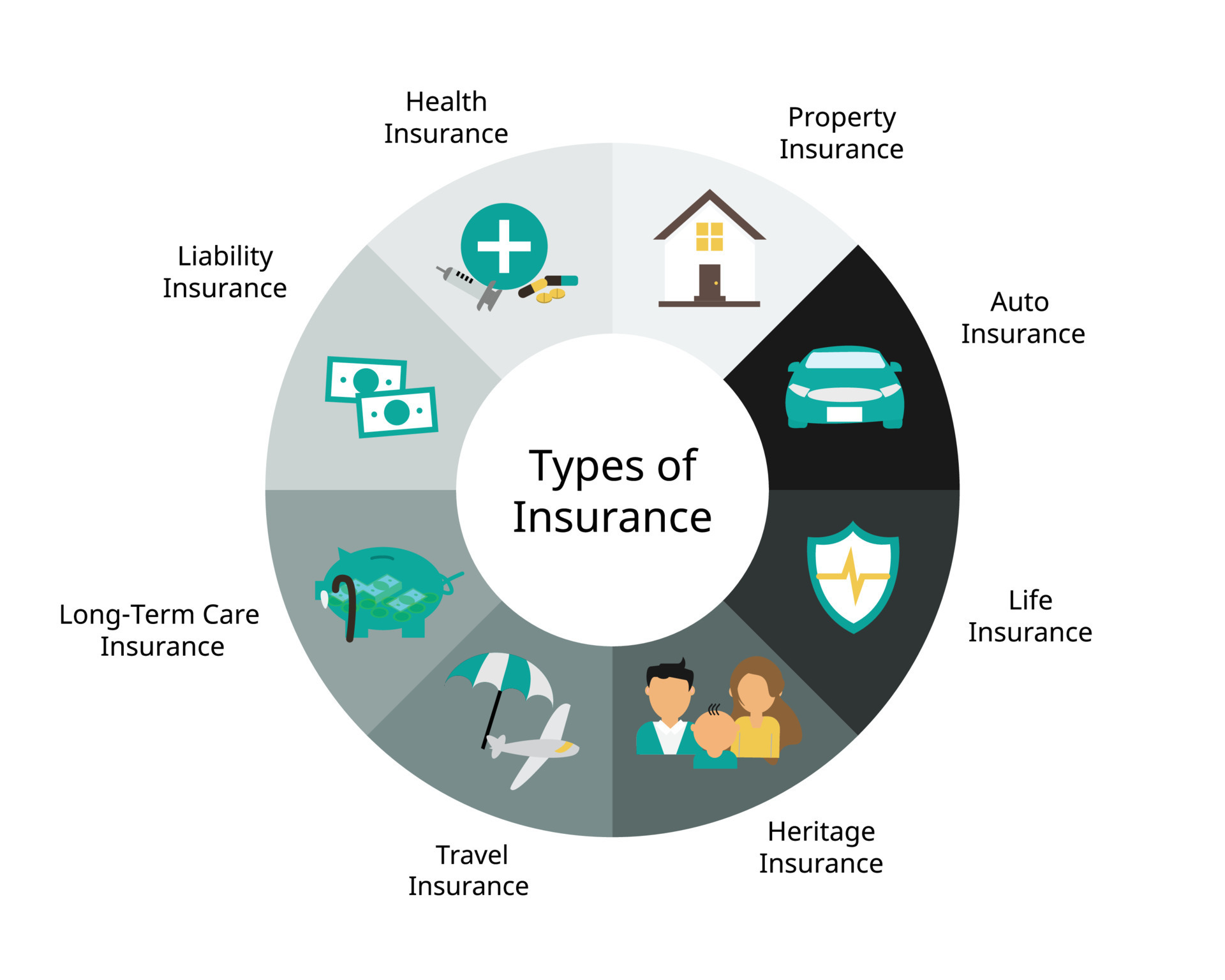

It may appear basic but recognizing insurance policy kinds can additionally be confusing. Much of this confusion comes from the insurance coverage market's ongoing goal to create customized protection for insurance holders. In developing flexible policies, there are a selection to choose fromand all of those insurance policy kinds can make it difficult to comprehend what a certain policy is and does.

Not known Factual Statements About Hsmb Advisory Llc

The very best place to start is to speak concerning the distinction between both types of standard life insurance policy: term life insurance policy and permanent life insurance policy. Term life insurance is life insurance policy that is just energetic temporarily period. If you pass away during this period, the individual or individuals you have actually named as beneficiaries might get the cash money payout of the plan.

However, lots of term life insurance coverage policies let you transform them to an entire life insurance policy plan, so you don't shed insurance coverage. Usually, term life insurance coverage plan premium repayments (what you pay monthly or year into your plan) are not locked in at the time of purchase, so every five or 10 years you possess the policy, your costs might climb.

They additionally often tend to be more affordable overall than whole life, unless you buy an entire life insurance plan when you're young. There are also a couple of variations on term life insurance policy. One, called team term life insurance policy, is usual amongst insurance coverage alternatives you could have accessibility to through your employer.

The Ultimate Guide To Hsmb Advisory Llc

Another variant that you might have accessibility to with your company is supplemental life insurance coverage., or funeral insuranceadditional protection that could help your household in situation something unexpected takes place to you.

Long-term life insurance coverage simply refers to any life insurance plan that does not expire.

Report this wiki page